What is an Operating Expense (OpEx)?

OpEx, short for operational expenditures, refers to the ongoing operational expenses that a company requires for its daily business. These costs are recurring and typically include things like employee salaries, rents and license fees.

OpEx:

Definition | Examples | Synonyms

Operational expenditures (OpEx) are the costs associated with the daily tasks of a business. These short-term expenses are fully deducted in the year they are incurred.

OpEx includes costs such as salaries, utilities and maintenance expenses. They are crucial for the smooth operation of the company and its projects. In project management, OpEx refers to the ongoing costs necessary to keep a project running.

A Practical Example

Imagine you are working on a software development project for a new mobile app. In this case, your OpEx might include:

- Salaries and wages: Developers, designers and testers have to be compensated for their work. These ongoing costs are often the largest part of the project.

- Server costs: To host the app and provide backend services, you need to rent servers or subscribe to cloud services. These monthly fees also fall under OpEx.

- License fees: You need to pay license fees for the software used in development. These costs occur regularly and are therefore part of OpEx.

- Maintenance and support: After launching the app, you need to maintain it, fix bugs and handle user requests. These support and maintenance costs are also included in OpEx.

- Office rent and equipment: Developers also need an office to meet and work in. The rent, electricity bills and office equipment are another part of OpEx.

Synonyms and Abbreviations

OpEx is an abbreviation for “operational expenditures”. It may be alternatively capitalized as opex or OPEX. The terms “operating expenditure” or “operating expenses” are also used from time to time.

Similarly, CapEx is the abbreviation for “capital expenditure”. It may also appear as capex or CAPEX.

FAQ

CapEx (capital expenditures) and OpEx (operational expenditures) are two different types of business expenses.

CapEx

This includes investments in long-term assets such as buildings, machinery, vehicles or computers. Such expenses are paid off over several years and not deducted immediately. CapEx is important for the growth and development of a company. The purchase of production equipment or the modernization of office buildings are examples of CapEx.

OpEx

These are the ongoing costs incurred for the daily operation of a business. These expenses are fully deducted in the year they are incurred. OpEx includes costs like salaries, utilities, rent and maintenance. They are crucial for the smooth operation of a business and its projects.

As a rule of thumb, CapEx refers to investments in long-term assets, while OpEx represents recurring expenses on the things that keep a business running.

In recent years, accounting strategies have caused a clear shift from investments in CapEx to expenditures in OpEx. This trend is particularly evident in digital products, but why?

Economic flexibility

By shifting from Capex to OpEx, companies avoid tying up their cash in physical capital and maintain liquidity. This is particularly beneficial when it comes to expensive items with short lifecycles, like IT equipment. Instead of investing large sums in purchases, companies can optimize their balance by leasing or renting goods, for example.

Adaptability in the face of technological change

The purchase of digital technology can be disadvantageous due to tight innovation cycles and the rapid depreciation in value that follows. An increasing number of companies are opting for service-based models instead of purchasing their technical equipment or software in order to keep pace with current technologies while minimizing maintenance and replacement tasks.

Flexibility and scalability

Pricing schemes that typically fall under OpEx provide companies with greater flexibility and scalability. For example, cloud computing services offer a pay-as-you-go pricing model, which does not bind companies to long-term contracts and requires payments only for actual usage.

Tax burden

OpEx expenditures are tax-deductible and reduce the company’s profit on its income statement. This sets them apart from CapEx investments, which are recorded on the balance sheet, depreciate over several years and are treated as an exchange of current assets for fixed assets.

Operational expenditures can negatively impact the project budget in various ways:

Excessive ongoing costs

If OpEx spirals out of control, it can lead to budget issues . Uncontrolled salaries, high rental costs or unnecessary operational expenses can financially burden the project and the entire organization.

Insufficient planning

If OpEx is not carefully planned, it can lead to unexpected costs. Lack of budget reserves for ongoing expenses can result in financial bottlenecks and jeopardize project progress.

Lack flexibility

If the project budget is too heavily focused on OpEx, there may be a lack of flexibility for strategic investments (e.g. in new technologies or training). This can affect the long-term competitiveness of the company.

Distorted profitability

If the operating expenses are too high, this can reduce the overall return on the project. An imbalanced ratio of OpEx to CapEx can affect profitability.

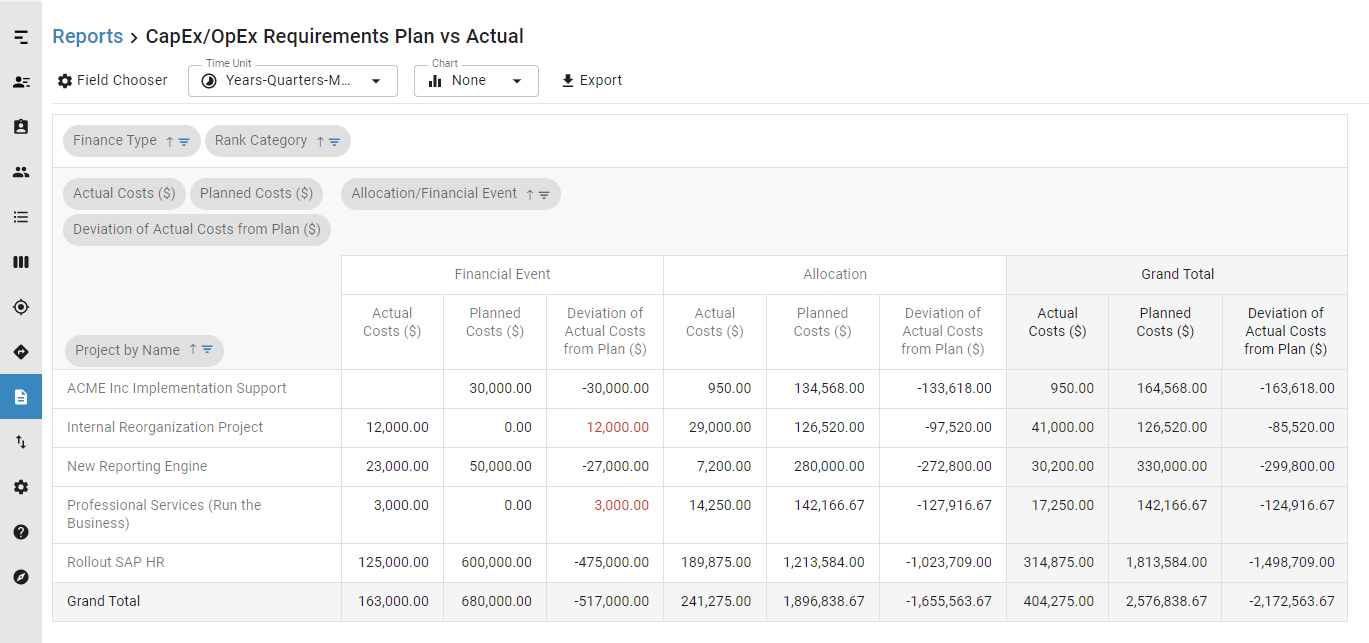

OpEx in Meisterplan

With Meisterplan, it’s particularly easy to keep track of project expenses – whether they’re operating or capital expenditures. You can enter them for each project and then regularly monitor them with plan vs. actuals comparisons or in separate reports. This ensures that your projects stay within budget or that your planning can be adjusted promptly when needed.

Discover More Here!

Dive even deeper into the topics of project, portfolio and resource management: Each page offers expert knowledge, product insights and a wealth of experience we'd like to share with you.

Actuals – Financials

Plan vs. Actuals