What is CapEx?

CapEx refers to the one-time expenditures of companies for long-term investments in technology, equipment, buildings, and machinery.

CapEx:

Definition | Examples | Synonyms

CapEx is short for “capital expenditures” and refers to the costs of a company’s long-term assets. These costs are usually investments to ensure the company can maintain or even increase their performance over a longer period of time.

Examples of CapEx include costs for:

- Land

- Buildings

- Machinery and equipment

- Technology such as software, hardware, and IT infrastructure

- Patents and licenses

- Renovations, maintenance, and upgrades for existing investments

A Practical Example

Let’s say you work for a company that designs and manufactures machinery and equipment. In order to remain competitive, as well as increase work efficiency and product quality in the long term, management has decided to build a new facility which would include modern equipment for production. The costs for this project are a one-time investment and tax-deductible as CapEx, as they are expenditure on long-term assets.

Synonyms and Abbreviations

CapEx may be alternatively capitalized as capex or CAPEX. The full term “capital expenses” or “capital expenditure” may also be used.

Similarly, OpEx is the abbreviation for “operational expenditures”. It may also appear as opex or OPEX.

FAQ

CapEx is an essential part of long-term financial planning and plays an important role in project portfolio management. To ensure the continuous profitability and success of your company, you should carefully plan and manage capital expenditure.

As part of project portfolio management, CapEx investments are often used to realize large-scale projects or to expand operational capacity. Companies must ensure that these investments are consistent with the company’s overall strategy and long-term goals. This often involves prioritizing projects based on their potential contribution to company growth and profitability.

CapEx is different from OpEx (operational expenditure), which relates to a company’s day-to-day operations.

OpEx is the ongoing, day-to-day costs that come up consistently. This includes employee salaries, rental costs for office space, costs for tool and software subscriptions, utilities, and property tax. OpEx can also be immediately deducted from taxes.

In comparison, CapEx costs go to larger purchases that are only made once and are therefore much more expensive than OpEx costs.

Some advantages of CapEx over OpEx are:

Tax Deductions to Increase Profit

Capital expenditure can be written off over longer periods of time, offering tax advantages to companies. Due to their high tax burden, they can be offset against profits.

Permanent Cost Savings

Long-term investments in the form of CapEx, such as purchasing office space instead of renting a building, can potentially save costs in the long run. Recurring payments can add up to be much higher than a one-time payment.

Stability

Capital expenditures are less volatile than operating expenditures because they are not dependent on short-term fluctuations.

A Sign of Growth

Capital expenditure investments increase a company’s assets. In healthy amounts, CapEx is considered by investors and analysts to be a sure sign of growth in companies.

Possible disadvantages of CapEx are the following:

High Initial Investments

Capital expenditures often require significant initial investments, which can impact the company’s liquidity.

Long-Term Resource Commitments

Capital expenditure is often a long-term investment in assets such as buildings or machinery. These resources are then tied up for a longer period of time.

Depreciation

Over time, assets can lose value. This can affect the profitability of CapEx. For example, machinery may get worn out over time, or technology can become outdated. As they depreciate, they reduce the company’s net income.

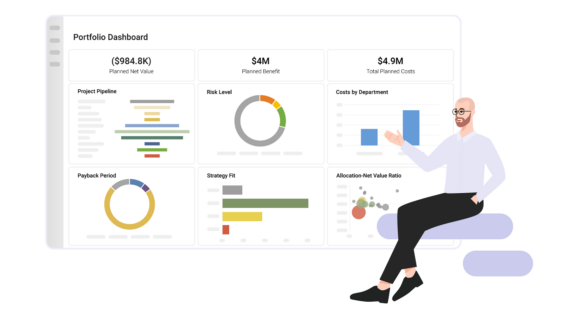

CapEx in Meisterplan

With Meisterplan, you can easily keep track of different projects and their costs. In Meisterplan, you can specify CapEx and OpEx cost types for all projects, roles, and financial events, as well as project and portfolio budgets.

Thanks to integrated actual values, plan vs. actual comparisons, and pivot reports, you can check on costs at any time. This enables a detailed evaluation of planned and actual operating and investment costs.

Discover More Here!

Dive even deeper into the topics of project, portfolio and resource management: Each page offers expert knowledge, product insights and a wealth of experience we'd like to share with you.

Financial Management

Western & Southern Financial Group Success Story